Part 1 - Carrier Contract Rules

Group contract will continue to have both participation and contribution guidelines for the plan sponsor (employer). Of course, these will need to be understood and followed. Enough said.

Part 2 - Contribution Discrimination

These rules remain vague and not in a final form for implementation ... discrimination for contributions could occur either by dollar or percentage amounts. Here are two examples that MIGHT work.

First ... understand the reason this is now an issue is because of Age Banding of Rates. Moving forward with renewals in 2014, the single rate or family rate are totally reformatted. So, now this new dynamic will cause compliance headaches for most employers ... some will NOT be able to comply and be "fair"!

Contribution Discrimination Compliance is focused on the comparison of the contribution dollars or percentage paid on behalf of the two groups of employees that are defined under ERISA ... HCE's (Highly Compensated Employees) and NHCE's (Non-Highly Compensated Employees) as well as groups or individuals defined and covered under Title VII of the Civil Rights Act ... (Age, Sex, Race, National Origin) and probably Military Service History and Marital Status. One way to provide Contribution Neutrality is to just "pay" employees a fixed dollar or percentage amount of their compensation for benefits or pay it based on years of seniority. Either, if applied consistently should result in a Contribution Discrimination test that passes.

Part 3 is where the real headache begins when employers realize this set of issues ... our responses will need to be client specific.

Part 3 - Section 125 Premium Conversion Compliance.

Unless the employer pays 100% of the health premiums for the employee, there will be a payroll deduction and that deduction will be done pre-tax under Section 125. Even the Premium Conversion provisions of Section 125 Plans have ERISA discrimination tests ... and unlike the PPACA contribution issue in Part 2 above, Section 125 tests are well established and clearly defined ... but widely unknown or misunderstood.

Section 125 Discrimination rules are clear that the HCE's can ONLY receive 25% of the total benefit of the Premium Conversion Plan. Said another way ... for every dollar that is deducted pre-tax from the total group of HCE's there must be three (3) dollars deducted from the NHCE's.

At first glance, this seems like a non-issue. But, the HCE's tend to be older and a far higher percentage of family coverage..

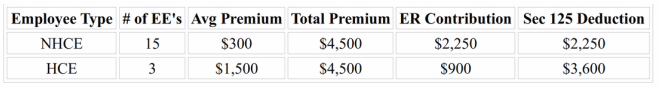

So, if the employer contribution is 50% of the single rate, it could look like this ...

In this chart, the company is paying 50% of the single rate. All the NHCE's are on single and average $300 per month premium. The HCE's have some family coverage and are older so their average premium is higher and the single rate for HCE's used is $600 per month. BOTH the contribution test and the Deduction tests FAIL! HCE's get double the $ amount in contribution even though the percentage is used and the HCE's are getting 61% of the benefit of the pre-tax Section 125 deductions.

The New Issue is a Double Bind

In the chart above, if the employer increases their contribution for NHCE's to make that more equitable, it will just make the Section 125 calculation move further away from the required 25/75% split that favors NHCE's. If the employer tries to reduce the deductions by increasing the contributions, that makes the contribution numbers worse.

So, what will work? This is going to be a significant problem. The core issue is the age banding of premiums will cause the gap between the premiums paid by HCE's and NHCE's larger. Trying to close the gap may only be possible by forcing the HCE's to pay an increasing about of their "share of the premium" with taxed dollars. It is an ugly but compliant solution.

What clients do will vary greatly from one group to the next, but this will need to be addressed, sooner rather than later because it involves deduction calculations that are cumulative on a calendar year basis ... and now it seems appropriate to say ... Happy New Year!

RSS Feed

RSS Feed